CADASHBOARD – SEE A DASHBOARD FOR YOUR BUSINESS

Issue #107

Salman Khan- Highest Taxpayer

Salman Khan beats Akshay Kumar by paying the highest advance tax for this fiscal year.According to IT department’s advance Tax payment data for 2015. Salman has paid a whopping Rs 20 Crore as advance tax, overtaking Akshay who paid Rs.16 Crore. Other top taxpayers are Big B, Ranbir Kapoor & Shahrukh Khan.

Bad loans hit ICICI Bank net profit growth

ICICI Bank Ltd, India’s largest private sector bank by assets, on Thursday posted its lowest profit growth in six years as a sharp rise in bad loans forced it to set aside more money to cover the risk of default.

India launches its urban makeover plan with smart cities

The government on Thursday picked 20 cities, including five state capitals, to launch its larger urban makeover plan.It proposes to invest Rs.50,802 crore on these cities, selected through a challenge, and is the first phase of the government’s plan to set up 100 smart cities. These 20 cities account for 3.54 crore people with city-wise population ranging from 2.58 lakh (New Delhi Municipal Council) to 55.78 lakh (Ahmedabad).

PM Narendra Modiji launched “Stand Up India” Movement. Click below link to view more

http://www.narendramodi.in/pm-to-launch-start-up-india-movement-tomorrow-399232&keyword=stand%20up

- Tea seller, Somnath Giram cracks CA, appointed as a brand Ambassador of Maharashtra Govt Scheme.

- Refunds for ITR filed online to be further hastened.

- Atulesh Jindal appointed as a new CBDT chairman

- RBI prints 1000 ruoee notes without silver security thread by mistake, notes printed in 5AG & 3 AP series.

- Tax Audit Limit for Business 2 Crore, for professional 1 Crore – Tax simplification committee

- PM Modi announces Rs 10,000 Crore fund, tax exemptions for start ups.

- Aadhar not mandatory for DBT scheme, clarifies RBI

International Section

Bank of Japan shocks markets with negative rates move

The Bank of Japan (BoJ) ramped up its aggressive stimulus campaign on Friday, adding negative interest rates on central banks deposits to its massive asset-buying programme, stunning financial markets that expected no action or a moderate increase in asset purchases.

Eurozone inflation increases to 0.4%

ECB President, Mario Draghi has already indicated another stimulus package could be unveiled as soon as March.The figures from the European Union's statistics office, Eurostat showed consumer prices were up 0.4% in January compared with a year earlier.It is double the rate of inflation in December.In the year to January energy prices fell 5.3% although that was less steep than in previous months

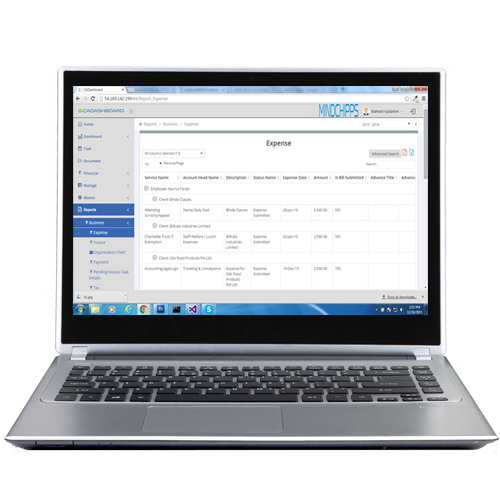

“Naya Avatar”

Beautiful and Clear

New UI which is simple but self-driven, makes it love at first site.

Better Use Experience

More modern design & improved usability.

High Configurability & Flexibility

Multiple options & operate the way you want.

Responsive Design

The design is optimised for mobile devices as well.

Improved Information Architecture

Makes it easy to find required information on site.

Compliance

Total control over compliance

Multi Location

Department/Branchwise seggregation

We are Social @ CADashboard.

Our Team with Somnath- The Man with Passion

They always say, what you believe in is what you do exactly!!

When you believe in your work and your abilities, then you are a real HERO – the successful Man! & to become a hero you don’t need to be born from a rich family or big city. It’s just all about the passion.

Yes, we are talking about the superhero who was just running tea stall & now with his great hard work and consistent efforts he has become Chartered Accountant - CA Somanth Giram.

From a small town, Karmala (Dist: Solapur) to Pune, it was not an easy task. Struggle with day to day realities and dream of becoming CA at one end.

CADASHBOARD team spend few moments with him and are just stunned with his thoughts and his lookout towards life. In his words “I would like to work with the help of technology and get myself enhanced rather than working in an old monotonous style.” Said Mr. Somnath. His secret lies in his simplicity, honesty and passion. Recently he has been appointed as a Brand ambassador for “Earn & Learn “scheme by Government of Maharashtra.

We at CADASHBOARD encourage & motivate his spirit and passion and support for his future endeavor

LIC Of India Vs. Insure Policy Plus Services Pvt. Ltd. & Ors(SC)(29 Dec, 2015)

Held: Parliament intended to allow all previous assignments and transfers provided that they complied with the requirements laid out in Section 38. In the face of this clear legislative intent, no other interpretation of Section 38 is possible. It is accordingly not incumbent for court to discuss whether insurance policies partake of the nature of social security, or whether the transfer of such policies tantamount to wagering contracts. It is not open to the Appellants to charter a course which is different to the postulation in the Insurance Act, by means of its own Circulars. The position obtains has diametrically opposite inasmuch as the statute permitted, at the relevant time, the assignment and/or transfer of life insurance policies, but the delegate, through its Circulars, has attempted to nullify that provision of law. Court conclude, therefore, that the circulars are ultra vires the Statute and must therefore be made ineffectual. Appeal dismissed.

Judgements/Tribunals

Content right to :eJurix

Balkrishna Industries Ltd. Vs. The Union of India and others(HC-Bom) (23 Dec, 2015)

Held:It is common ground before court that up until 2015 no exemption was ever granted from payment of Safeguard Duty levied under section 8C of the CTA, 1975. An exemption by its very nature is a freedom from an obligation which the exemptee is otherwise liable to discharge. It is a privilege granting an advantage not available to others. An exemption under a statutory provision in a taxing statute is by its nature a concession granted by the Under Notification No.96/2009-Cus. dated 11th September 2009, admittedly no exemption was ever granted from payment of Safeguard Duty imposed under section 8C of the CTA, 1975. As noted earlier, the two sections clearly operate in two different fields. Whilst section 8B is article specific, section 8C is article specific and country specific inasmuch as imposition of Transitional Product Specific Safeguard Duty under section 8C comes into play only with reference to a specific article that is imported from the People's Republic of China. Therefore, there is a clear distinction between the two sections and if the Government, as a policy, decides to exempt one and not the other, the same cannot be termed as an unreasonable classification requiring courts interference. This being purely a policy matter decided by experts in the field, cannot be subjected to a judicial review in this fashion. Writ Petition dismissed.

Limtex Tea & Industries Ltd. Vs. Asstt. C.I.T(ITAT-CAL)(15 Jan, 2016)

Held:The subsidy in question is revenue subsidy and was rightly brought to tax. The Finance Act, 2015 with effect from 01/04/2016 has inserted of Sub-Clause (xviii) in Section 2(24) of the Income Tax Act, 1961 providing an inclusive definition of the expression 'Income'. any subsidy/grant/reimbursement, which is taken into account and reduced from the actual cost of depreciable assets while determining the same under Section 43(1) shall not be treated as income. The second part is that, if the value of the subsidy is reduced from the value of actual cost u/s.43(1) of the Act for allowing depreciation, than the subsidy will not be taxed as "income”.Therefore the 1st part cannot be regarded as having retrospective operation. The second part of the amended provision of Sec.2(24)(xviii) of the Act gives a relief in the form of relieving double taxation, one in the form of the subsidy being taxed as income and again the value of subsidy being reduced from the actual cost of fixed assets on which depreciation is to be allowed. It is not possible to regard one part of an amended provision as having retrospective operation and the other part having only prospective operation. In the present case there is no dispute that the other conditions laid down in Explanation 10 to Sec.43(1) of the Act are satisfied. Appeal dismissed.

Blog

Knowledge is Power!

And empowering knowledge is Data! Today, given innovations in products and competition within an industry, the concept of a stable growth path or a tapering productivity line does not exist. Industry of any kind is on the path where a constant growth means survival and slowdown means a slow though sure death.

Profits, performance and prerogatives are some of the imperatives of any industry if they are to survive- more so in today's competitive times. Cold figures and statistics are then the drivers of these requirements across industries.

In such times getting the right information at the right time and manner is an imperative which makes the difference between survival and growth versus demise. Industry does not have the luxury of depending upon external data to forecast the path of growth for itself. It is for these all-too-important reasons that industry and industrial set-up of any kind, large or small have to have in place an elaborate system of capturing information, working on it and churning out data in the relevant formats.

One initiative which is now making its impact felt on data gathering and analysis is that of Cloud-based Applications like CADashboard. Powering that is Pune-based Mindchipp, a prominent player of repute in this niche market. Its usefulness can be gauged from the fact that it totally frees the organization from the confines of owning, operating and upgrading system and all its inherent complexities, and lets the latter do what it does best: produce, sell and respond to customer queries. In fact, the best part besides the obvious ones mentioned before is that it does not try to re-invent the wheel but only makes it lighter, stronger and wear-resistant. You continue doing what you were always good at….and let people like Mindchipp run the infrastructure as regards systems are concerned. Being a cloud-based activity, your costs and hassles go down but productivity improves and so does data storage and security.

This ideally is something every professional organization ought to invest in. Besides taking away the hassles of owning and operating an arm which may be miles away from an organization’s aims and objectives, the latest systems and software aid in giving the most accurate of results- instantly. Complex algorithms backed by the latest software help organizations get very detailed reports of sectors and effects which might have otherwise been lost. All this, at the wink of an eye!

Need we say more about Cloud-based Applications? Most likely not! Eating to prove the pudding might be a luxury for most. The same though can’t be said for industries. Here it is an imperative to get it right, first time and every time.

We believe in this drive & would like to have you with Us!!

Start Up-Stand Up !!