GRAB your DIWALI Offer @ CADashboard..!!

Chinese whispers they say are designed to create confusion. More so if it is the Chinese themselves creating it!

Could this be……about the Chinese economy…? God forbid. There is far too much for the World to lose if China goes down than us losing a bit due to its currency devaluation.

But how else does one read this? Within a span of a fortnight China is again in the news….for all the wrong reasons. First it was the Stock Market Crash…and now this devaluation (they call it Correction by the way!).

With its economy slowing and exports getting hit by as much as 8.3% due to domestic price rise, this was expected in a way…but not in such a way as this!

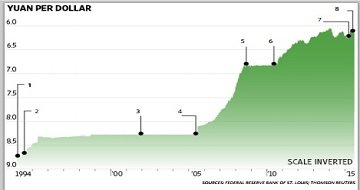

August 11 was the date when all started. It was a controlled drop of the Yuan by 1.9% against the USD- nothing alarming it seemed. When the picture finally emerged, it became apparent that the Yuan fell between 6.11

to 6.22 against the dollar, marking an overall fall close to 2 to 3% - something certainly alarming!

This was the first time in three years that the Yuan fell so low against the USD. In fact, it was the biggest ever

in the last two decades!

And it does not end here. Given that China contributes close to 15% of the World’s GDP put together, even a 2% devaluation with its multiplier effect snowballs into a huge sum. There is now

a fear in the International Markets that countries in the ASEAN and SAARC regions may well be tempted to competitively devalue their currencies to keep pace with what China has done and all this might lead to a global slowdown.

And this still does not stop the Chinese from further devaluing their currency!

Given the statistics and the scenario, how does all this affect us in India?

There is this other school of thoughts which takes this entire devaluation issue in a more studied manner. Apparently given the Chinese Government’s desire to make the RMB an international currency figuring in the list forming the IMF’s SDRs (Special Drawing Rights) thus placing it close to the USD and Euro, the IMF could have directed the Chinese Government to do certain course correction besides value corrections to their currency to be taken seriously. If this is the primary reason, there is no way that this devaluation may affect the Chinese economy adversely in the long run.

For the present, enjoy the windfall coming your way in the form of reduced prices, oil or otherwise…and increased exports! The rest, only time will tell!