On October 14, 2014

Share On:

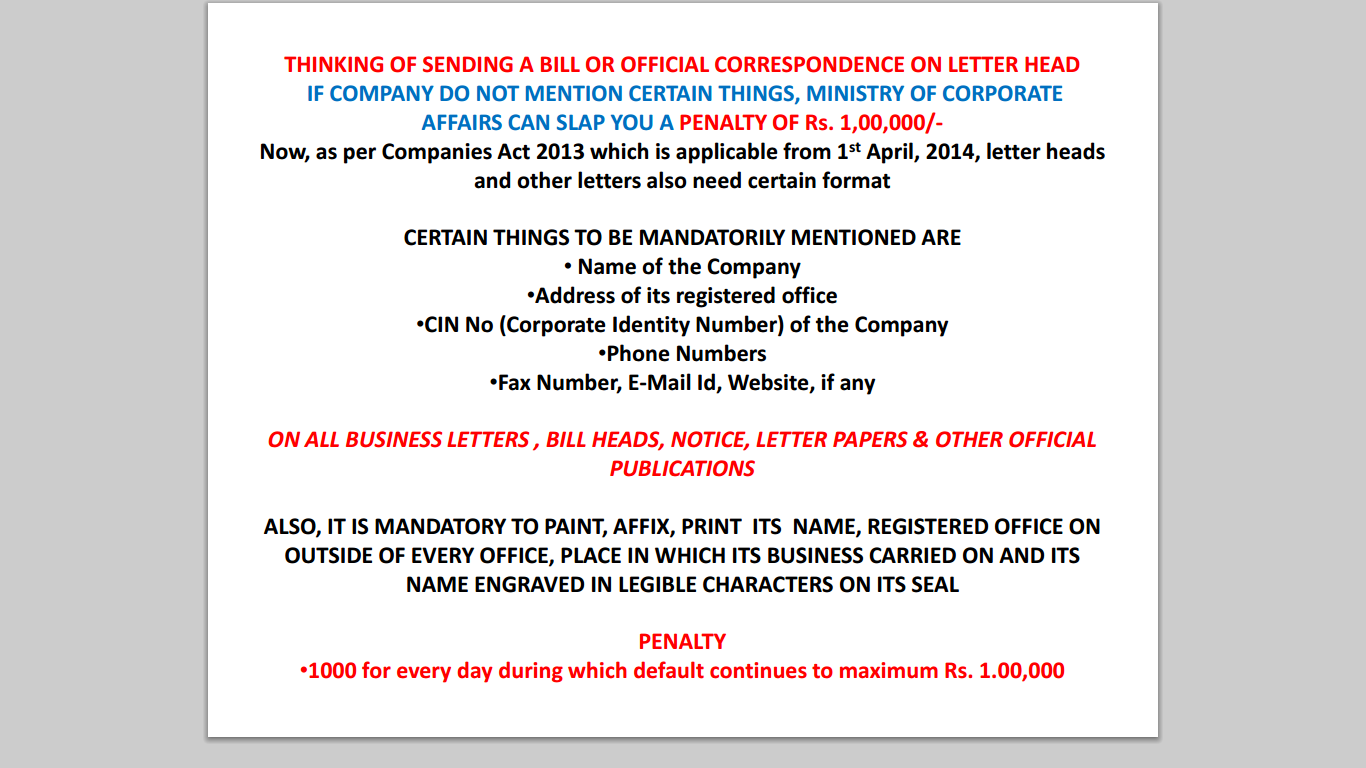

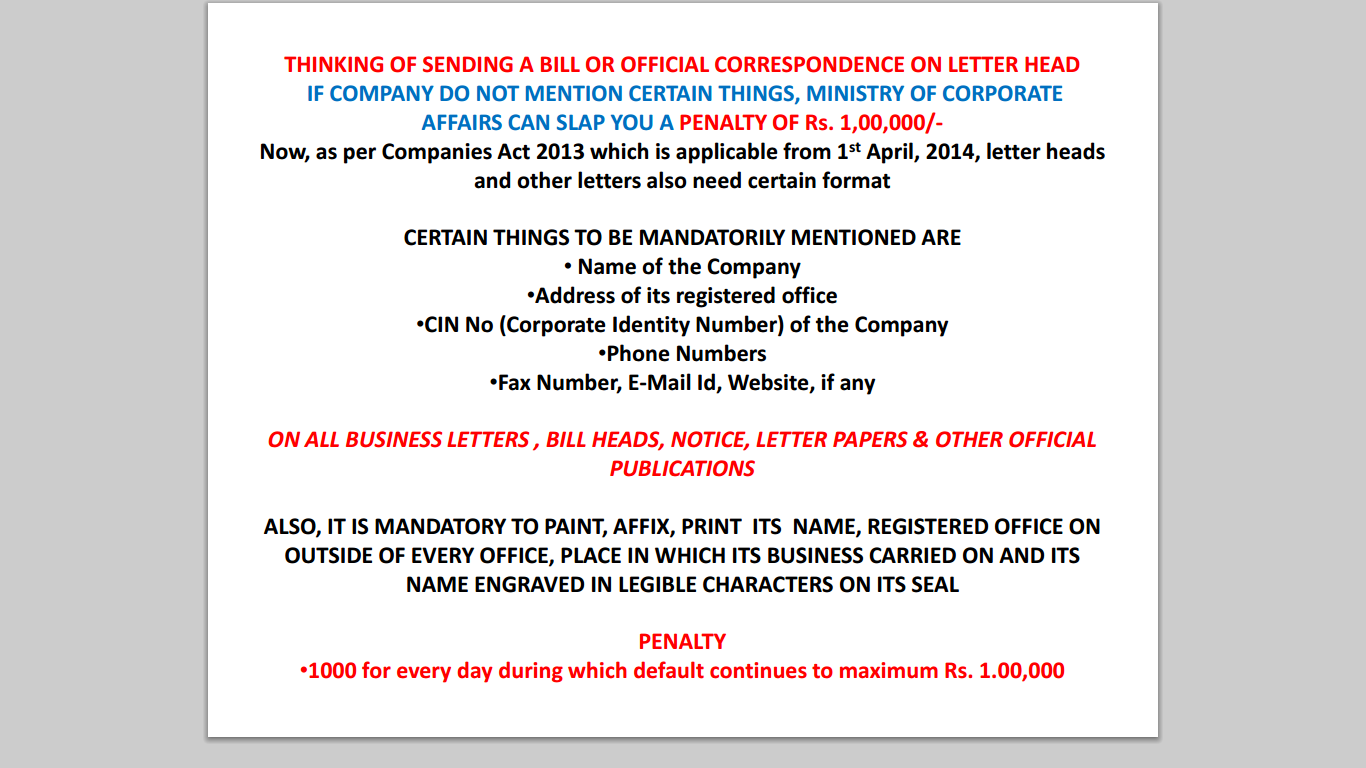

The recently enacted Companies Act, 2013 ('the Act') is a landmark legislation with far-reaching consequences on all companies incorporated in India. A part of the Act had already become effective with the notification of 98 sections in September 2013. Further on 26 March 2014, the MCA has notified most of the remaining sections. These sections have been notified to come into effect from 1 April 2014. The MCA has also published the several chapters of the related rules, and the remaining rules in respect of the notified sections are expected to be released by 31 March 2014. This is a landmark legislation that will have a wide ranging impact on corporate India.

The Act in a comprehensive form purports to deal with various aspects of corporate India and Indian companies will have to closely examine these developments to develop a clear strategy at ensuring compliance per the new requirements.

Key Highlights

Incorporation of Company:

- Incorporation of a One Person Company has been permitted. One person can form a private limited company.

- Numbers of permissible members in private company has been raised to 200 as against existing limit of 50 members.

- Limit of number of members in an association or partnership (without incorporation) to be increased up to 100

- Small company is introduced for lesser regulatory framework

- Objects clause in the Memorandum of Association of a company not required to be divided into main, ancillary and other objects. Only the objects for which the company is incorporated along with matters considered necessary for its furtherance to be mentioned. The company cannot provide for other object clause.

Incorporation of Company:

- Shares, other than sweat equity, cannot be issued at a discount.

- Reduction of share capital is subject to the approval of Tribunal.

- A company may issue preference shares redeemable after 20 years for infrastructure projects as may be specified and redeemed as may be prescribed on an annual basis at the option of such preference shareholders.

- Buyback provisions eased. Companies can buy back its shares even if it has defaulted in repayment of deposit or interest payable thereon, redemption of debentures or preference shares or payment of dividend to any shareholder or repayment of any term loan or interest payable thereon to any financial institution or bank, provided that such default has been remedied and three years have lapsed after such default ceased to subsist. This was not the case in the Companies Act, 1956.

- Debenture trustee to be appointed only when a company issues prospectus or makes an offer or invitation to the public or to its members exceeding five hundred for subscription to its debentures.

Acceptance of Deposit by Companies:

- NBFC’s not to be covered by the provisions relating to acceptance of deposits. They will be governed by the Reserve Bank of India rules on acceptance of deposits.

- Deposit insurance is required to be provided as prescribed.

- Deposits can be secured and unsecured.

- The concept of small depositors is dispensed with.

- The Tribunal may allow further time taking into consideration the financial condition of the Company to issue directions for repayment of the deposits or interest thereon in case of default in such repayments.

Acceptance of Deposit by Companies:

- Forms & Certification

- E-Governance proposed for various company processes like maintenance and

inspection of documents in electronic form, option of keeping of books of accounts in

electronic form, financial statements to be placed on company’s website, holding of

board meetings through video conferencing/other electronic mode; voting through

electronic means

- For all the companies (except one person companies and small companies) with prescribed paid up capital and turnover, whether private or public, listed or unlisted, annual return has to be signed by a company secretary in practice.

- Meetings

- One Person company is not required to hold any Annual General Meeting

- One Person company is not required to hold any Annual General Meeting

- For special business to be transacted in the General Meeting, explanatory statement should comprise of specified information

- Company should follow that secretarial standards are folled while making mintues

- Secretarial Audit

- All Listed companies to annex secretarial audit report obtained from a Practicing Company Secretary to the Board’s report.

- Board to respond to qualifications, made by the Secretary, in the Board’s report.

- Annual Documents

- Requirement of compliance certificate done away with and in its place scope of annual return has been enlarged.

- The annual return, filed by a listed company or, by a company having such paid-up capital and turnover as may be prescribed, shall be certified by a company secretary in practice in the prescribed form, stating that the annual return discloses the facts correctly and adequately and that the company has complied with all the provisions of this Act.

- Directors responsibility statement shall include additional statement realted to compliance to all applicable laws and in case of listed companies, it shall include statement related to internal financial control.

- Benefit of private companies to file their balance sheet and profit and loss account separately has been withdrawn

According to industry estimates the top 300 companies are audited by 10 firms and experts say the mandatory rotation within the next three years could trigger a lot of chaos and confusion. Similar challenges will exist for many companies. So it is very important for the companies and the auditing firms to have all the information organized and available at one place. These firms should start using Software to have all the information at one place. CADashboard will help the companies and auditing firms to effectively collaborate with each other and avoid future compliance challenges.

CADashBoard is one such platform which chartered accountants can use.

Comments